Deep Collaboration: Why Adobe Had to Buy Figma

What the $20B deal signals for the future of Deep Collaboration

Adobe just announced its intention to buy Figma for $20B, which would be amongst the largest software acquisitions in history. More notable still is the timing and price paid; $20B represents a 50x multiple of ARR at a time when public comps are trading around one-tenth that level.

Why is Adobe willing to risk so much to buy Figma? Because it has to. With this acquisition, Adobe is recognizing that its persona-based approach to software is the past, and Figma’s job-to-be-done-based (JTBD) approach is the future.

Why dropping the “er” enabled Figma to build the future

Adobe’s software suite was built using the paradigm that has been the standard for software design for the past 20 years: focusing on the needs of a specific persona. Adobe targeted the designer and built a robust set of tools for them; Photoshop, Illustrator, and InDesign are all laden with extensive features to help the designer do their job.

The flip side of this narrow focus on designers is that the suite isn’t easily accessible by non-designers. The learning curve is steep. And, critically, the software wasn’t built with collaboration tooling. Since Adobe was focused on designers, there wasn’t a need to build tooling for cross-functional collaboration. As a result, “collaborating” in the Adobe suite looks largely like emailing files back and forth. This friction dissuades other personas from getting involved in the design process. And isn’t a great experience for the designers collaborating amongst themselves.

Figma flipped this paradigm on its head. Instead of building for designers, Figma built for design. Many personas are involved in the job-to-be-done of design, from product managers to researchers, to developers, to marketers. By focusing on the JTBD from the beginning, Figma built a product that welcomed each of these personas, featuring easy onboarding and a heavy emphasis on collaboration. Figma embedded in-line commenting and “multi-player” functionality from the earliest days. As it grew, it added richer collaboration features like Figjam with the goal of ensuring the complete JTBD of design could be done within the app instead of scattered across myriad productivity and collaboration tools.

By dropping the “er”—focusing on design instead of designers—Figma built a tremendously valuable business. More than 65% of its users are outside of the design function. This cross-functional spread has led to phenomenal net revenue retention of over 150%, amongst the very best in software today.

Deep Collaboration: the future of enterprise software

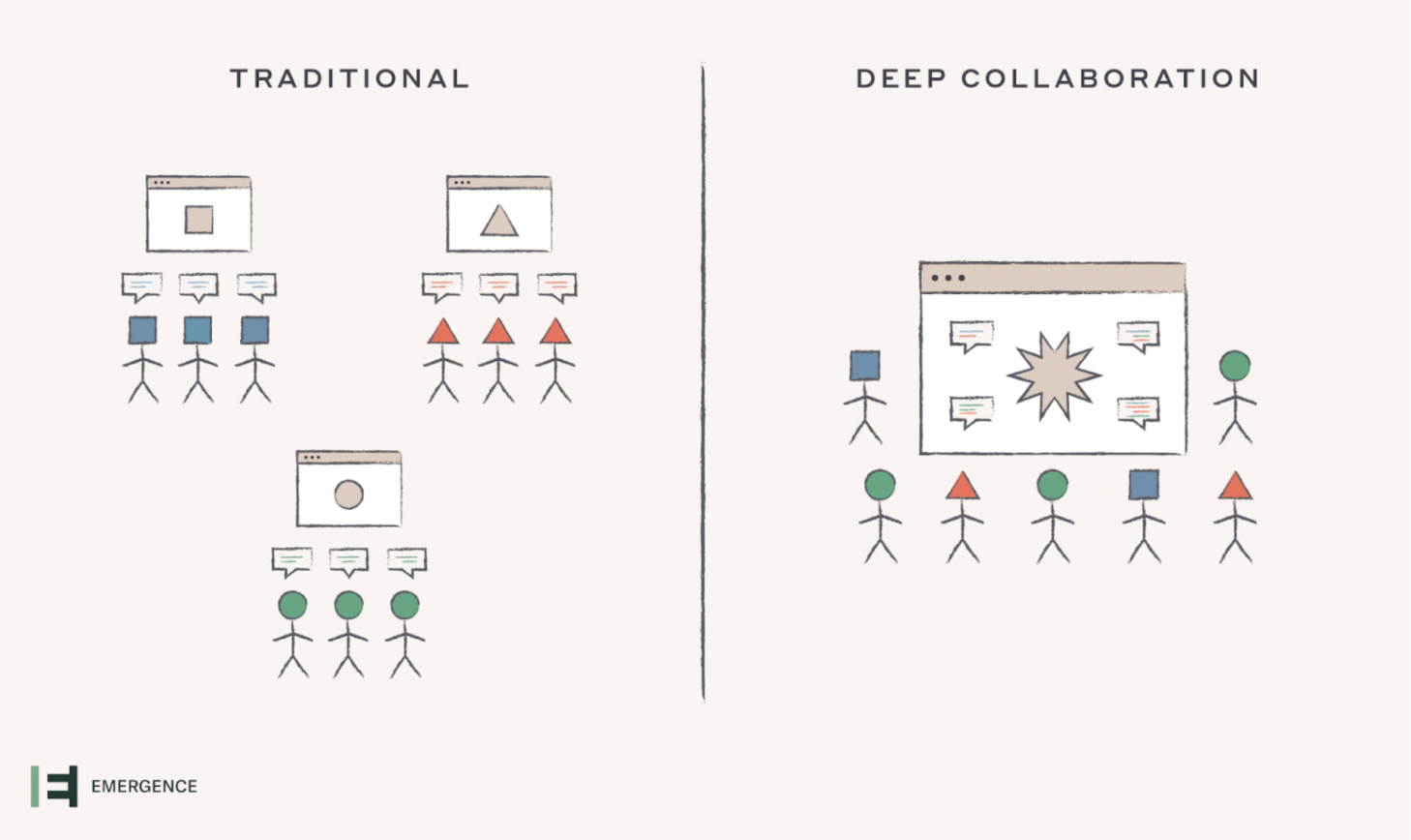

We call the emerging category of products that are built JTBD-first “Deep Collaboration”. This software combines productivity and collaboration functionality in one place to get a specific, cross-functional job done. Instead of doing work in one place and then talking about that work across many scattered places, Deep Collaboration creates a single destination to build and collaborate around a specific JTBD. And it enables all the people involved in that JTBD to collaborate effectively, resulting in a job better done.

To facilitate this, Deep Collaboration software includes:

- JTBD-specific collaboration embedded next to the work itself. In Figma’s case, the core JTBD-collaboration tooling started with browser-based multi-player drawing and commenting functionality. They later added audio and other in-line collaboration features.

- JBTD-specific workflow, in contrast to generic horizontal workflow

- Robust and granular persona-based permissioning and approvals. This allows personas from across the organization to access specific features

- Pricing and packaging models that promote cross-organization expansion, e.g. free viewer tiers, lightweight collaborators, and power user pricing

The proposed Figma/Adobe deal isn’t the first major transaction in Deep Collaboration. Salesforce’s $28B acquisition of Slack was aimed at bringing together Slack’s collaboration functionality with Salesforce's sales productivity tooling. While the integration is still ongoing, the potential to embed collaboration within Salesforce could change the way the JTBD of sales gets done, enabling better internal collaboration for sales teams and better external collaboration with prospects. We wrote about the Deep Collaboration implications of this acquisition here.

A number of earlier-stage startups are leveraging Deep Collaboration principles to drive rapid growth and strong net revenue retention.

Ironclad builds digital contract management software. The legacy players in this space were focused on building for lawyers. Ironclad is focused on the JTBD of drafting, negotiating, and tracking contracts. Almost every persona in a company is involved in this JTBD. By building with robust permissioning and JTBD-specific workflow, these personas can collaborate more effectively in Ironclad, leading to faster contract cycles, lower overhead, and better alignment.

Indeed, some of the most active users of Ironclad are sales reps. By simplifying and speeding up the contracting process, Ironclad has become a highly valuable sales enablement tool.

Ironclad’s cross-functional deployment has allowed them to build healthier customer relationships. Customers who have more than six user personas using Ironclad have 20% higher new business annual contract value and 20% higher net dollar retention than those with three or fewer personas. In other words, the more user personas a customer onboards to Ironclad, the more valuable the experience to the customer and, thus, to Ironclad.

Procurement has long been siloed, manual, and slow. Traditional procurement processes require three to six teams and disparate systems, which lack transparency and visibility and waste valuable time.

Zip uses the JTBD framework to streamline the procurement process for all employees and all departments. Built for collaboration, Zip gives employees across teams access to a consumer-style experience to fast-track buying approvals. According to Zip, CFOs report more compliance and savings by consolidating procurement tools to one centralized platform.

Product research is another JTBD that has traditionally been siloed, full of friction, and thus, too often neglected. In the absence of effective research tooling, companies often skip research and instead waste money building products their users don’t use, only to find out after launching.

Maze is focused on building the platform for the product research JTBD, enabling all the personas involved in this process, from designers to marketers to researchers, to easily get feedback on prototypes and then collaborate on this feedback. As the company continues to roll out collaborative features, the diversification of their user personas has increased to a point where no persona represents more than one-third of the total. Consequently, net revenue retention has increased apace.

Unlock market potential by leveraging the JTBD framework

In addition to increasing net revenue retention, dropping the “er” can unlock significantly larger total addressable market (TAM) opportunities. Per LinkedIn data, there are ~1M UX designers in the US, representing the bulk of the addressable market for Adobe’s persona-based approach. There are ~8M people in product management, front-end development, and product marketing, which are all addressable with Figma’s JTBD approach. Instead of targeting the ~200K in-house legal people in the US, Ironclad can instead target the ~4M people involved in sales, HR, procurement, etc.

The TAM opportunity isn’t limited to internal collaboration. By integrating productivity and collaboration in one place, Deep Collaboration companies can also create cross-organization expansion opportunities. Ironclad is now expanding to be the platform for cross-organization contract negotiations, eliminating the need for counterparties to email back-and-forth redlines.

While the market opportunities for each of these companies are significantly higher than their persona-based counterparts, there are still a number of challenges Deep Collaboration founders need to solve in order to navigate this new paradigm. Specifically:

- How to define the scope of the JTBD and identify where to focus the product initially

- How to price and package and whether to offer a free tier or free viewers

- How to build the best sales overlay model and which persona’s budget to target initially

We’re excited to work with founders building the next generation of software to help answer these questions.

Ironclad and Maze are Emergence portfolio companies. An earlier version of this post was featured in Fast Company.

Enjoying this article?

Sign up to gain access to our thought leadership and have future articles delivered directly to your email.